Insurance:

AI-Powered Insurance Fraud Prevention & Deepfake Detection

Real-time multimodal verification for claims, onboarding and underwriting

Combat $80B+ in Annual Insurance Fraud with AI Precision

AI-Powered Insurance Fraud Detection

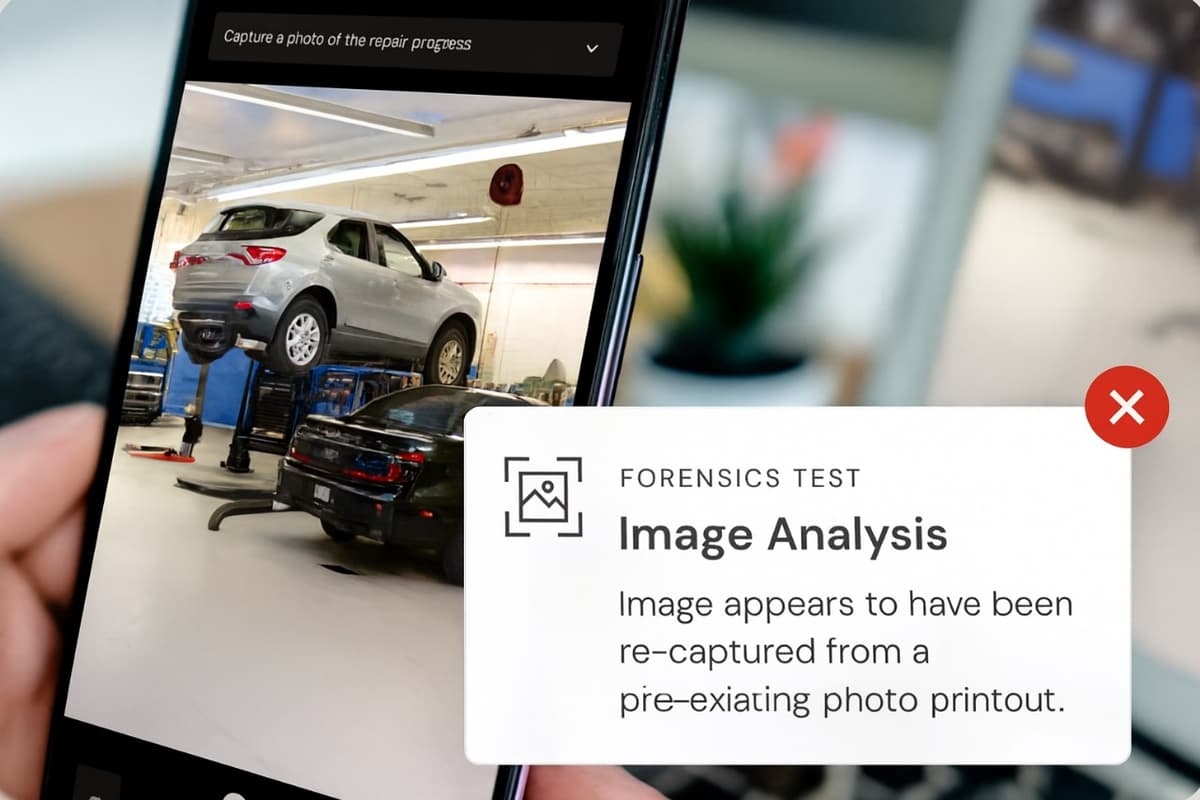

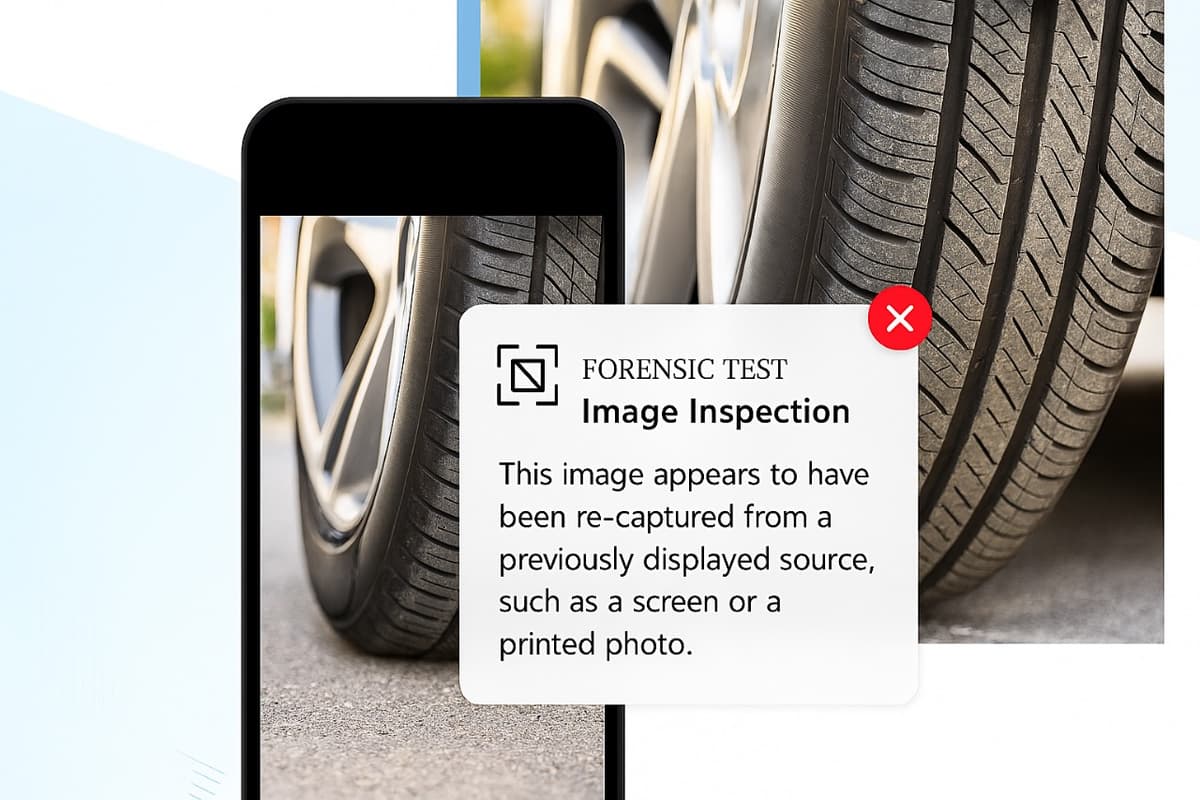

deeptrack's advanced neural authenticity engine detects sophisticated fraud attempts including deepfake damage photos, synthetic claims, rebroadcast attacks, and object reuse schemes. Our insurance fraud detection AI analyzes vehicle images, documents, and metadata in real-time, providing confidence scores and authenticity reports to prevent fraudulent payouts.

Real-Time Fraud Detection

Our AI neural authenticity engine analyzes images, video and documents instantly — detecting deepfakes, manipulated photos, and synthetic claims at submission time.

Multimodal Verification

Simultaneous verification of images, videos, documents and metadata enables a unified authenticity score and automated decisioning for claim approvals.

Advanced Fraud Pattern Detection

deeptrack identifies sophisticated fraud patterns including object reuse (same damaged parts reused across claims), rebroadcast attacks (reusing prior images), and geo-location inconsistencies. Our AI detects when photos weren't captured at the claimed location and identifies matching serial numbers across different claims, providing comprehensive insurance fraud prevention.

Seamless Integration & Regulatory Compliance

Virtual Inspections & Automated Verification:

Replace expensive onsite inspections with trusted virtual verifications using deeptrack's AI-powered platform. Customers and repair shops can submit claims instantly while our system ensures photo and video integrity.

Enterprise-Grade Security & Compliance:

deeptrack meets GDPR and ISO standards while integrating seamlessly into existing claims processing workflows via API, providing detailed audit trails and authenticity reports for reinsurance and compliance.